Latest data from The Deposit Protection Service (The DPS) have revealed that average UK rents increased by more than a third (36.2%) than the rate of inflation during the past year.

Average rents for Q3 2023 now stand at £1,121.46 per month, a rise of £93.79 or 9.13% compared to the same period last year, outstripping the annual September 2022-3 UK CPI inflation rate of 6.70% by more than 36%.

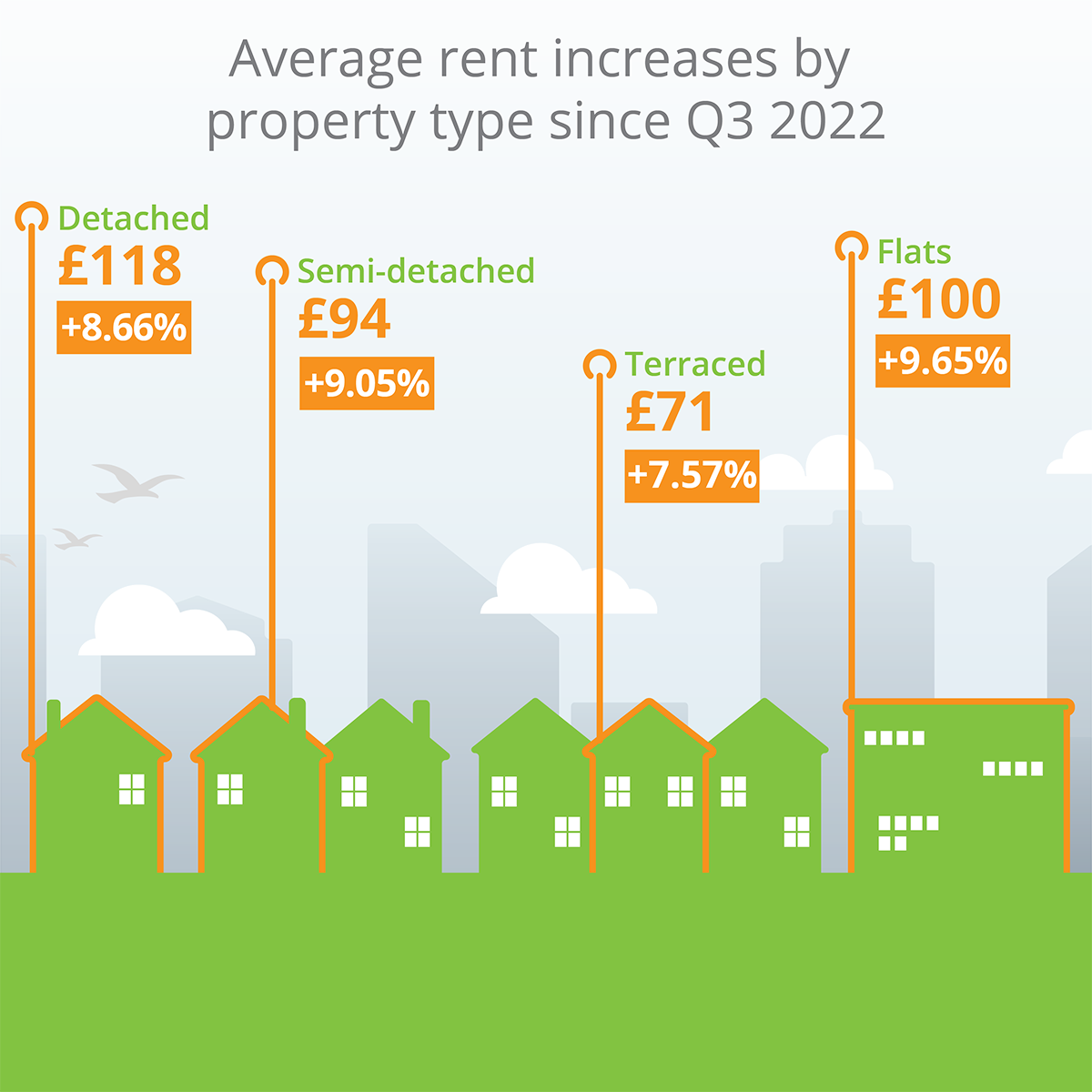

In terms of property types, flats have experienced the largest increase in percentage terms, up 9.65% (£99.96) over the period, now standing at £1136.20 per month. Semi-detached properties are now £1128.60 per month, up by 9.05% (£93.66), Detached up by 8.66% (£117.61) to £1475.56 per month, and terraced properties up by 7.57% (£71.30) now standing at £1013.26 per month.

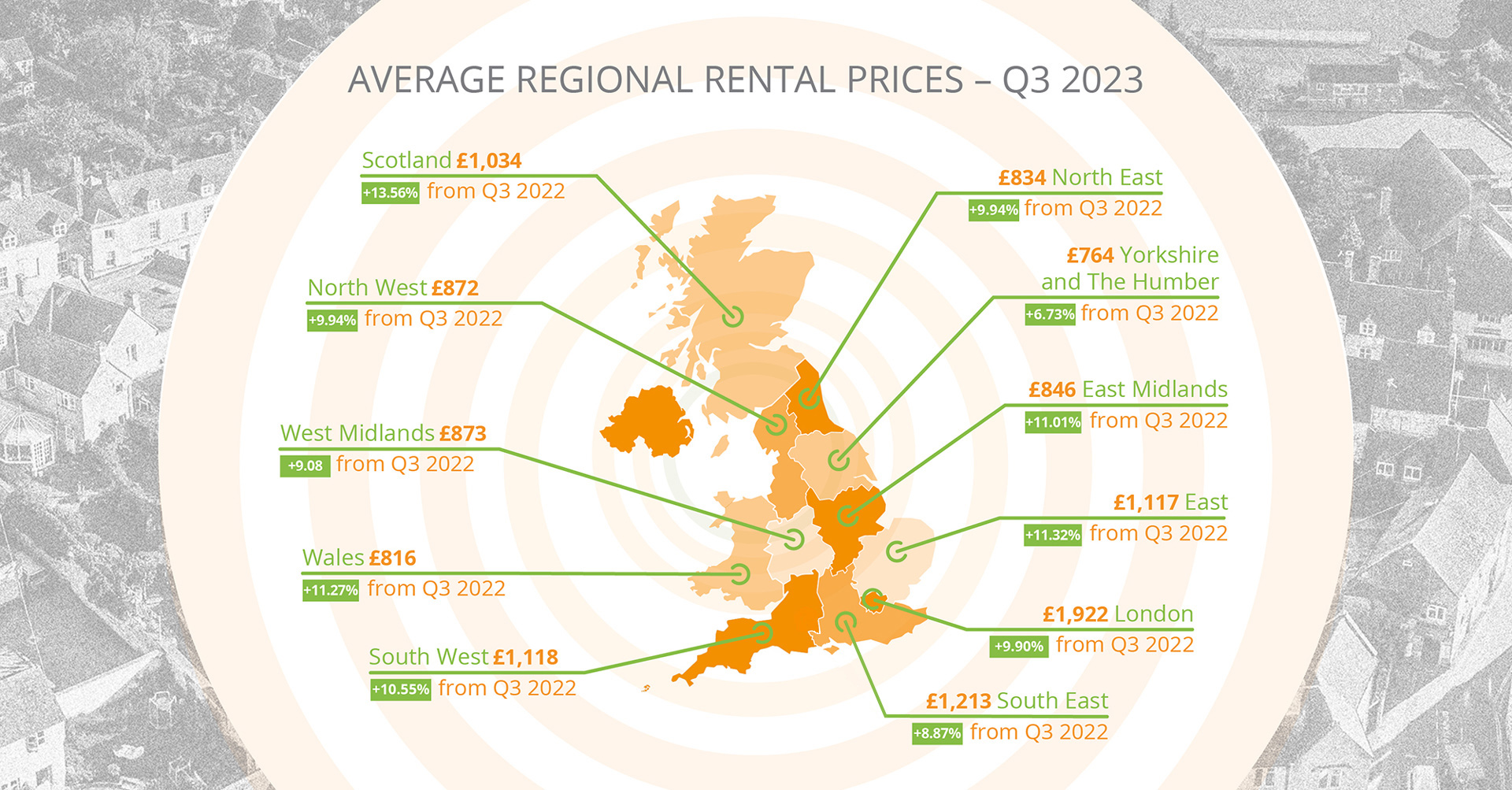

Across the UK, every region has seen significant annual increases in average monthly rents, outstripping CPI in every region, with only Yorkshire seeing an annual increase close to CPI at 6.73%, Again, are we comparing the annual rent increase in Yorkshire with the monthly inflation or annual inflation figure that ends September? The largest percentage increase regionally was seen in Scotland at 13.56% (£123.45) where average rents now stand at £1033.80 per month. The second highest increase of 11.32% being seen in The East, rising £113.55 to £1116.87 per month. The largest increase in pure value terms was seen in London with average monthly rents costing £173.13 more than 12 months ago, up 13.31% to £1922.37.

A combination of demand for rental property and cost of living pressure appears to be fuelling rental growth across the board, with average rents for all property types increasing in every region over the last 12 months. The highest annual percentage increase of any property type was for Flats in the East, rising 16.88% (£149.36) to £1034.41 per month. The highest rise in pure value terms was for Detached properties in the South East, up £208.84 (12.66%) to £1,857.81 per month.

“Every region across the UK has witnessed inflation-beating rent increases during the past 12 months.

“The combination of increasing demand for rental property and cost-of-living pressures seems to be fuelling sustained rent rises.

“Rent increases are also affecting every type of property, whether flats, terraced, semi-detached or detached, which may also reflect demand for rental property outstripping supply in many parts of the UK.”

Matt Trevett, Managing Director, The DPS

Want more from your deposit protection provider?

Want more from your deposit protection provider?

Our free quarterly DPS Rent Index is just one of the reasons our customers rate us excellent on Trustpilot. Find out more and register for a DPS custodial account at depositprotection.com/join